Algonquin, IL Businesses: Should You File A BOI to FinCEN?

The Corporate Transparency Act (CTA) required many U.S. businesses to submit Beneficial Ownership Information (BOI) to FinCEN, ensuring transparency and combating financial crimes.

While a Texas federal district court’s preliminary injunction puts this requirement on hold, many experts expect that to be overturned. In that event, failure to file could lead to fines of $500 per day, up to a maximum of $10,000, and possible criminal penalties.

Read on to determine whether you should take any further action.

Action Plan for Compliance

1. Determine if Your Business Must File

Most corporations, LLCs, and similar entities must file unless exempt, such as banks, publicly traded companies, or nonprofits.

2. Identify Your Beneficial Owners

Beneficial owners are individuals who either control the business or own 25% or more of it.

3. Collect the Required Information

Gather details including:

-

Business name, address, and formation details

-

Owners' names, dates of birth, addresses, and identification documents

4. Submit Your BOI Report

Deadlines:

-

Existing companies (formed before 01/01/2024): File by 01/01/2025.

-

New companies (formed in 2024): File within 90 days of creation.

-

Companies formed after 01/01/2025: File within 30 days of creation.

Learn how ZenBusiness can simplify BOI filing.

Key Details About BOI Reporting

Who Needs to File?

Businesses classified as "reporting companies" include most LLCs and corporations. For instance, a small marketing consultancy based in Algonquin, IL, structured as an LLC, is required to file unless exempt. Exempt entities include banks, publicly traded companies, and charities.

What is a Beneficial Owner?

A beneficial owner is anyone who:

-

Exercises substantial control (e.g., decision-making authority), or

-

Holds at least 25% ownership of the company.

For example, in a local boutique co-owned by two partners, each holding 50% ownership, both partners are considered beneficial owners.

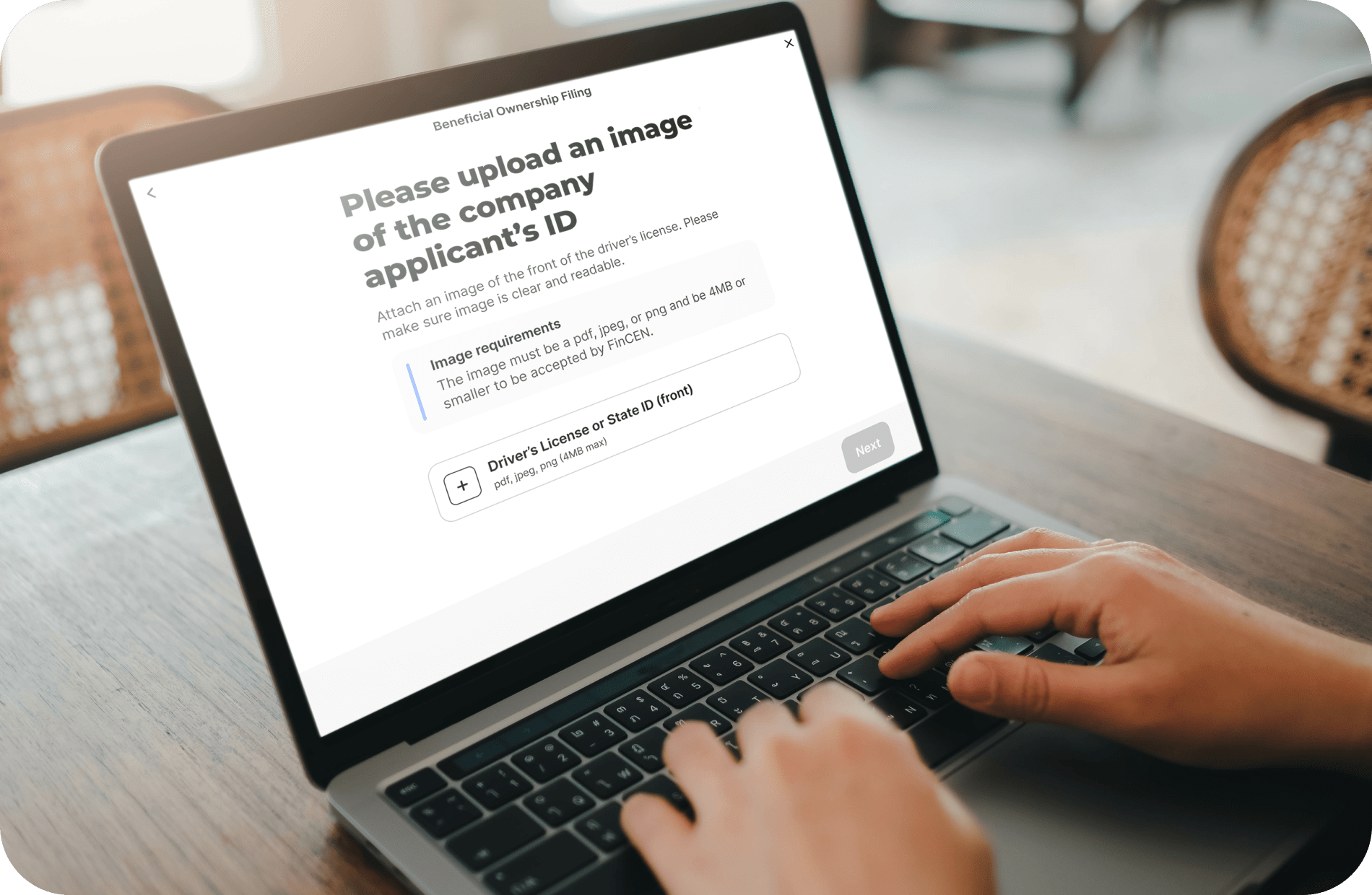

What Information is Needed?

BOI reports must include:

-

Business details: name, address, and formation information

-

Owner details: names, dates of birth, addresses, and valid ID documents

How and When to File

Reports are submitted electronically via FinCEN’s system. Filing deadlines depend on the business formation date:

-

Existing companies (formed before 01/01/2024) must file by 01/01/2025.

-

Companies formed in 2024 must file within 90 days.

-

Companies formed after 01/01/2025 must file within 30 days.

Potential Penalties for Non-Compliance

While a Texas federal district court’s preliminary injunction puts this requirement on hold, many experts expect that to be overturned. In that event, failure to file could lead to fines of $500 per day, up to a maximum of $10,000, and possible criminal penalties.

How ZenBusiness Can Help

Should you decide to file your BOI, ZenBusiness provides expert guidance for BOI filing, ensuring your business meets all requirements efficiently. Their service saves time and eliminates stress. Learn more about their filing assistance.

Additional Resources

We Want to Hear from You!

Your input makes a difference! Take a few minutes to complete our BOI survey by December 18, 2024, and for every 25 responses, our Chamber will receive a $100 donation. [Take the survey here!] Thank you for supporting our Chamber and sharing your feedback!

*As of December 3, 2024, a Texas federal district court has issued a preliminary injunction for all states to block the CTA and its relevant regulations. However, filing your BOI will help you avoid fines if this injunction is overruled.