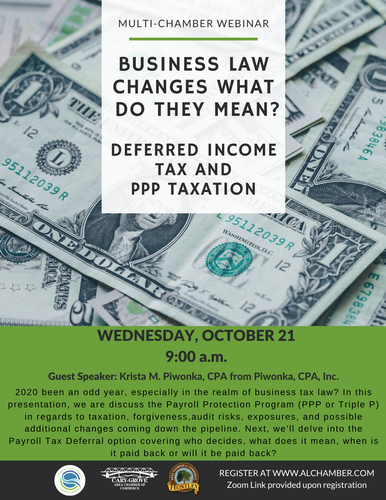

Tax Law Changes - Deferred Income Tax and the PPP

Hasn’t 2020 been an odd year, especially in the realm of business tax law? In this presentation, we are going to discuss the Payroll Protection Program (PPP or Triple P) in regards to taxation, forgiveness, audit risks, exposures, and possible additional changes coming down the pipeline. Next, we’ll delve into the Payroll Tax Deferral option covering who decides, what does it mean, when is it paid back or will it be paid back?

Bio:

Krista Piwonka brings more than 20 years of experience in accounting and taxation to her clients. In 2008, she opened her own firm with a handful of friends as clients and now assists >400 clients with five employees. Her firm specializes in micro-businesses (mom & pop) and balancing the tax implications of the business returns on the personal returns, including payroll, retirement savings, etc., and vice versa.

Krista often tells clients that her job is like a musical sound board technician. In order to get the best sound all the slides on the board need to be in balance with each other. If one is out of balance the sound is off and the performance isn’t ideal. Additionally, the pieces don’t get “set” never to move again, they are constantly changing. Think of the various pieces on Krista’s desk as being cash, payroll, business income/loss, spouse’s income, retirement savings, tax law, withholdings, dependents, 529 Plans, etc. All those are moving pieces. How do we position the “pieces” to get the ideal tax minimization strategy legally?

Date and Time

Wednesday Oct 21, 2020

9:00 AM - 11:00 AM CDT

Location

This meeting will be held virtually via Zoom and participants will be emailed the link within 24 hours of the event's start time.